Follow us on social media:

Runtime: 8:48

0:00 GM UAW Workers Get $12,000+ Profit Sharing

1:36 Hyundai IONIQ 6 Gets 4.6 Mi/kWh

2:36 BYD Gets Into Car Insurance

3:33 Ford Mach-E Hit By Tesla Price War

4:33 VinFast Slashes Prices, Too

5:07 GM, Rheinmetall Get U.S. Army Contract

6:40 China EV Industry Sets Big Milestones

7:19 GM Sourcing Lithium in the U.S.

7:51 VW Could Make Battery Cells in Canada

Visit our sponsors to thank them for their support of Autoline Daily: Bridgestone, Intrepid Control Systems, and Schaeffler.

This is Autoline Daily, the show dedicated to enthusiasts of the global automotive industry.

GM UAW WORKERS GET $12,000+ PROFIT SHARING

This is the time of year when automakers report their year end earnings, and this morning General Motors posted its numbers for 2022. It sold 5.9 million vehicles last year, which was down 5.6% from 2021. Sales were actually up in North and South America, but they fell in the rest of the world, mainly in China. Baojun, Wuling and Buick all posted big drops in sales. But even though its sales were down overall, GM’s revenue for the year shot up by nearly $30 billion to a total of over $156 billion. That’s a 23% increase. And yet, most of that increase didn’t fall to the bottom line. GM posted a net profit of $9.9 billion, which was down almost 1%. So where did that money go? Here are some of the biggest items. GM lost nearly $3.2 billion on Cruise, it had to pay out $657 million to close down its operations in Russia, and it set aside $511 million to pay Buick dealers who took buyouts rather than commit to selling electric cars. As I said earlier, GM did really well in North America. Its wholesale deliveries there were up 26%, and it posted an EBIT profit of nearly $13 billion, so its UAW employees will get profit sharing checks averaging more than $12,000.

| GM 2022 Earnings | ||

|---|---|---|

| Sales | 5.9 Million | -5.6% |

| Revenue | $156 Billion | +23% |

| Net Profit | $9.9 Billion | -1% |

HYUNDAI IONIQ 6 GETS 4.6 MILES/KWH

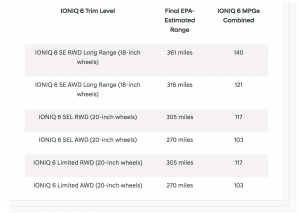

The Hyundai IONIQ 6 will be one of, if not the most-efficient, EV when it goes on sale in the U.S. this spring. The electric sedan finished its final EPA testing and was rated at an estimated 361 miles or 581 kilometers of range. With a 77.4 kWh battery pack it means the IONIQ 6 can get up to over 4.6 miles per kWh. That ties it with certain versions of the Lucid Air at the top of the list, as does its 140 miles per gallon equivalent. These figures apply to the rear-drive version with 18-inch wheels. If you factor in all the setups, range will go as low as 270 miles with AWD and 20-inch wheels. Aerodynamics is part of the reason the IONIQ 6 is so efficient. Its drag coefficient is only 0.22, which makes it one of the best in the industry.

BYD GETS INTO CAR INSURANCE

Could this be a new trend in the auto industry, car companies selling car insurance? Tesla was the first to do it. Then General Motors started selling insurance through OnStar and now Reuters reports that Chinese automaker BYD is in talks to buy an insurance company, too. So we won’t be surprised if other automakers decide they want to get into this business.

FORD MACH-E HIT BY TESLA PRICE WAR

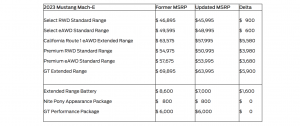

Tesla’s price cuts continue to have a ripple effect throughout the industry. Ford announced it’s slashing the price of the Mach-E in the U.S. anywhere from $600 to $5,900 and the price of its optional Extended Range Battery by $1,600. As we reported before, the U.S. treats some models of the Mach-E like a sedan, which have a lower price threshold to qualify for the EV tax credits. So, with these cuts more models will qualify. In fact, the base MSRP with the federal subsidy will be $38,495. Ford says anyone waiting for delivery will automatically get the lower price and it will reach out with some sort of offer to customers who bought their car after January 1st of this year. It also hopes to significantly cut vehicle wait times by increasing production. Ford makes the Mach E in Mexico and China and says it will boost production to 130,000 units this year.

VINFAST SLASHES PRICES, TOO

And Ford isn’t the only one slashing EV prices. Vietnamese automaker VinFast revealed a new promotional program in the U.S. that cuts the starting price of its VF 8 model by $6,500 as well as a direct discount of $3,000. That brings the starting price down to about $47,000. We think most automakers will probably offer discounts and deals on their EVs instead of chopping the MSRP. Because once you cut the MSRP, it really hurts your residual values.

GM, RHEINMETALL GET U.S. ARMY CONTRACT

Because of Russia’s invasion of Ukraine and worries that China may invade Taiwan, military budgets are going up in Western countries as well as in Japan and South Korea. General Motors got back into the defense business in a serious way in 2017 and it just landed a contract for the first phase of the US Army’s program to replace its heavy tactical trucks. GM partnered with American Rheinmetall, the US subsidiary of the German company Rheinmetall. They’re proposing that the Army use its HX3, which is based on a heavy truck from MAN, the German truck maker. The trucks feature an interchangeable protected cab design, ADAS, and drive by wire operation, as well as fully autonomous capability. The Army wants to buy 40,000 of what it calls the CTT, or Common Tactical Truck. The program could be worth $14 billion.

CHINA EV INDUSTRY SETS BIG MILESTONES

The EV market in China is rocketing along. Nio just set a milestone of doing 60,000 battery swaps in a single day and now it says it did more than 900,000 swaps in the 17 days of the Chinese New Year holiday, averaging about 52,000 a day. Wuling also set a milestone with its MINI EV. It sold more than 550,000 last year, a gain of 30% and it accounted for nearly 10% of all BEV sales in China in 2022. And thanks to that big year, the model has now passed 1.1 million total sales since it was launched.

GM SOURCING LITHIUM IN U.S.

We keep seeing Western automakers make progress in their efforts to find alternative sources for raw materials for EV batteries that don’t come from China. General Motors is making a $650 million investment in Lithium Americas to mine lithium at Thacker Pass in Nevada, which is the largest known source of lithium in the U.S. Production is expected to kick-off in 2026 and the amount of lithium extracted from the site is estimated to support production of 1 million EVs per year. (Thacker Pass Pictured)

VW COULD MAKE BATTERY CELLS IN CANADA

And Volkswagen is turning to North America for battery cell manufacturing. It could open a factory in Ontario, Canada. Germany’s Handelsblatt newspaper reports that VW filed paperwork with the province but a VW spokesperson says the company hasn’t made a decision yet on a location for a North American battery plant. We think it’s likely that VW will probably do it. Making battery cells in Canada could help it qualify for EV subsidies from the US Inflation Reduction Act.

But that wraps up this show. Thanks for making Autoline a part of your day.

Thanks to our partner for embedding Autoline Daily on its website: WardsAuto.com

Seamus and Sean McElroy cover the latest news in the automotive industry for Autoline Daily.